Purchasing your first home is one of the most exciting decisions in your life. Although this is a massive milestone, it pays to be fully prepared with all the essential knowledge to navigate this purchase successfully.

Firstly, Victorian homebuyers should be aware of the steps for choosing their dream property, including how to select the perfect location. When it comes time to purchase, most first home-buyers will usually follow three different purchasing methods: a private sale, an auction or an off-the-plan sale.

Our first-home guide will also break down the other key checkpoints for Victorians to consider when working through their purchase journey. In particular, the role of First Home Buyer Grants and Concessions and all the hidden fees to be wary of. Taking into consideration our guide should hopefully help take out some of the stress to get you buying with confidence.

How to Choose Your First Home

When choosing your first home, it’s important that you research potential properties in different locations for one that aligns with your personal lifestyle. Try to consider different factors such as its location to work opportunities, the quality of schools and hospitals, as well as local amenities and public transport. Knowing how much you can afford will also help you decide on where to purchase your first home.

You may also consider choosing between different housing types. For example, a house and land package is when a buyer secures a block of land and the construction of a home in one streamlined process. These packages are common within master-planned communities such as Harlowe, and are often cheaper than buying an established home because you pay considerably less in stamp duty.

Different cities and suburbs will typically have different median property prices. Although the property market can change rapidly, particularly in Melbourne, it’s vital that if you’re unfamiliar with market trends and the long-term prospects of different areas, you consult with a professional agent. They should also have the experience to help you find a region that suits your goals, and may suggest a first home in places you hadn’t thought to look.

It’s also a great idea to start attending inspections and auctions in your chosen area. This can give you an idea of the kinds of houses you should expect while also getting you better prepared for when it’s time to purchase.

How to Buy Your First Home

Buying your first home can be completed through a variety of different purchasing methods. The following are four of the most common:

Auction

Auctions are one of the most popular purchasing methods in Australia, giving first-home buyers the chance to secure a property quickly. To buy, there usually won’t be an exact asking price; rather, the seller may provide a guide price or price range. This number is based on similar properties and may not be reflective of the seller’s reserve price, which is the minimum amount they’re willing to accept.

Prior to the auction, you will need to register with the seller’s agent if you’re looking to bid. On auction day, potential buyers will bid for the property, with the process managed by an auctioneer. Once the gavel drops and you secure your property, you’ll need to be financially prepared as an immediate deposit (around 10%) will be required on that day. Once you’ve secured your property, there is little cooling period with contracts signed fast, so it’s important to prepare well in advance and make sure it’s definitely the property you want to buy.

Private sale

Also known as a “private treaty,” this method involves purchasing a property from an advertised fixed price or price range. Through a private sale, interested buyers can submit offers directly to the seller’s agent, which may lead to a price negotiation. Throughout the lifetime of the listing, sellers may receive and consider different offers from potential buyers until a price is accepted. Negotiation is a key part of this method, as buyers may often start by submitting offers below the asking price and working their way up.

Unlike auctions, there is a longer cooling-off period with a private sale, which is typically around three days in Victoria. This gives buyers valuable time to properly inspect the property and arrange their finances to make a final decision.

Off-the-plan

This is where you purchase a property that hasn’t been built yet or is still under construction. These are usually purchased directly from a developer and include the cost of the land and the cost of building your home. Because your final property does not exist, you will sign your contract based on blueprints and designs.

An off-the-plan purchase can be a great option because of the potential savings. Stamp duty is the payment you make to the government when you purchase a property, based on its value at the time of sale. Because nothing has been technically built, you can save big on stamp duty because you’re essentially only paying for land. Settlement is also delayed until construction is finished, giving you much more time to save. However, an off-the-plan purchase does come with uncertainty. Construction timelines may be delayed, and the finished product may not always live up to your expectations.

First Home Buyer Checklist

When you’re ready to buy your first home, it can seem like there are a lot of things being thrown at you. To help you balance your priorities and feel prepared to complete your purchase smoothly, please read through some of the major considerations in our checklist:

Assess Your Financial Readiness

Before you even begin searching for properties, it’s helpful to be aware of how much you can afford to buy. You can determine this by calculating your personal savings, income and your current expenses to establish a realistic idea of how much you can afford for a house deposit as well as ongoing mortgage payments. Discussing this with your bank lender should help you find your borrowing capacity.

Factor in Additional Costs

Buying a home will cost you more than just the purchase price. It’s also important to factor in any additional costs. These will typically include stamp duty, which is a one-time tax fee you’ll need to pay for transferring the ownership of a home, typically adding between 1.4% to 5.5% to your purchase price. You should also factor in any land transfer fees, cost for building inspections or moving costs. Many first-home buyers make the mistake of underestimating these additional costs, so we recommend constructing a detailed budget list with both upfront and ongoing costs prior to making an offer.

Explore First Home Buyer Grants and Concessions

As first-home buyers, you have access to helpful concessions in Victoria to help support you financially. Make sure you check your eligibility for the following:

- First Home Owner Grant (FHOG)

This is a one-off payment to help first-home buyers purchase or build a new home. Under the FHOG, eligible buyers in Victoria can receive a grant of $10,000 for buying a property worth less than $750,000. For more information on the scheme and to check your eligibility, please visit their website. - Stamp Duty Exemptions or Concessions

As first-home buyers, you can also access considerable concessions on stamp duty. If your property is below $600,00, then you have a full exemption from stamp duty and won’t have to pay anything. If your property is between $600,001–$750,000, you still pay stamp duty at a reduced amount.

Conduct Thorough Property Research

As we’ve previously discussed, it is beneficial to conduct property research within an area or suburb that suits your personal lifestyle and budget. Once you’ve ascertained your financial readiness, you can match your borrowing capacity to an area you can afford. Try to also stay up-to-date with all of the latest market trends, and understand the trends for property prices in your area, which can help you make smarter decisions. Reaching out to knowledgeable real estate agents can help your research significantly, particularly if it’s a local agent who specialises in a certain area and can give local expertise.

Part of your research will also involve attending property inspections to evaluate their suitability firsthand. Make sure you consider all parts of the property, take detailed notes and weigh up the pros and cons of each. Not all potential problems may reveal themselves immediately, so try to be rigorous during an inspection.

Understand the Legal Process and Make an Offer

Once you’ve found the right property for you, submit an offer to your seller’s real estate agent. Be prepared for negotiations as you work with the seller to find a good deal.

When you choose to buy any property, you will have to work through complex legal documents. These typically include the contract of sale, land transfer duty paperwork and any body corporate or utility agreements. These documents can be a lot, especially for a first-home buyer. Make sure you contact a conveyancer or solicitor to ensure you understand all contract details, and everything listed within is fair and protects your interests.

Finalise Your Home Loan and Prepare for Settlement

Once your offer has been accepted by the seller and you’ve finished signing your legal documents, you can move forward with settlement. This is when ownership officially passes from the seller to you, where any legal documents are finalised, and you pay off the final balance of the sale price. Your settlement period can last between one and four months, with most homeowners having a conveyancer or solicitor by their side to ensure everything runs smoothly.

Prepare to move in

Once you’ve passed the settlement phase, the property is officially yours. Collect your keys from your real estate agent, and organise for movers to help you transfer your belongings. Ensure all of your utilities are connected, and update your address across your personal Medicare, bank and other relevant accounts.

Common Mistakes to Avoid

Buying your first home is a major financial decision that shouldn’t be taken lightly. Mistakes can happen that can cause frustrating delays to your final move-in date. To try and keep your new acquisition moving forward without unnecessary stress, take into account some of the following mistakes to avoid:

Skipping Pre-Approval

Getting pre-approval means your lender has agreed to lend you an amount of money in principle, based on an assessment of your finances. This shouldn’t be skipped over, as it gives you clarity on your budget to make finding a home easier. It can also make you more attractive to sellers by showing that you’re a serious buyer with pre-approval organised.

Overlooking Additional Costs

It can be easy to just be focused on the purchase price of your property. Especially when budgeting for your first purchase, it’s vital that you don’t overlook any extra costs. Payments through stamp duty, legal fees and any moving expenses can quickly add up.

Compromising on Location

Make sure you research your property’s location as much as the property itself. You may consider a less desirable location to get a more affordable house; however, this can be impactful in the long run. Especially, if you are planning to stay long-term, investigate factors such as its local amenities, schools, and proximity to work to ensure you can maximise your own living experience.

Not reading the fine print

When you receive your contract, it can be lengthy and full of terms and conditions. It’s vitally important that you understand every clause in your contract, because if you just skim through this can lead to potential risks. These forms will contain information on any special contingencies and settlement dates, so we recommend consulting with a legal expert or conveyancer if you’re unsure about any details.

Why is Harlowe the Perfect Place to Buy Your First Home?

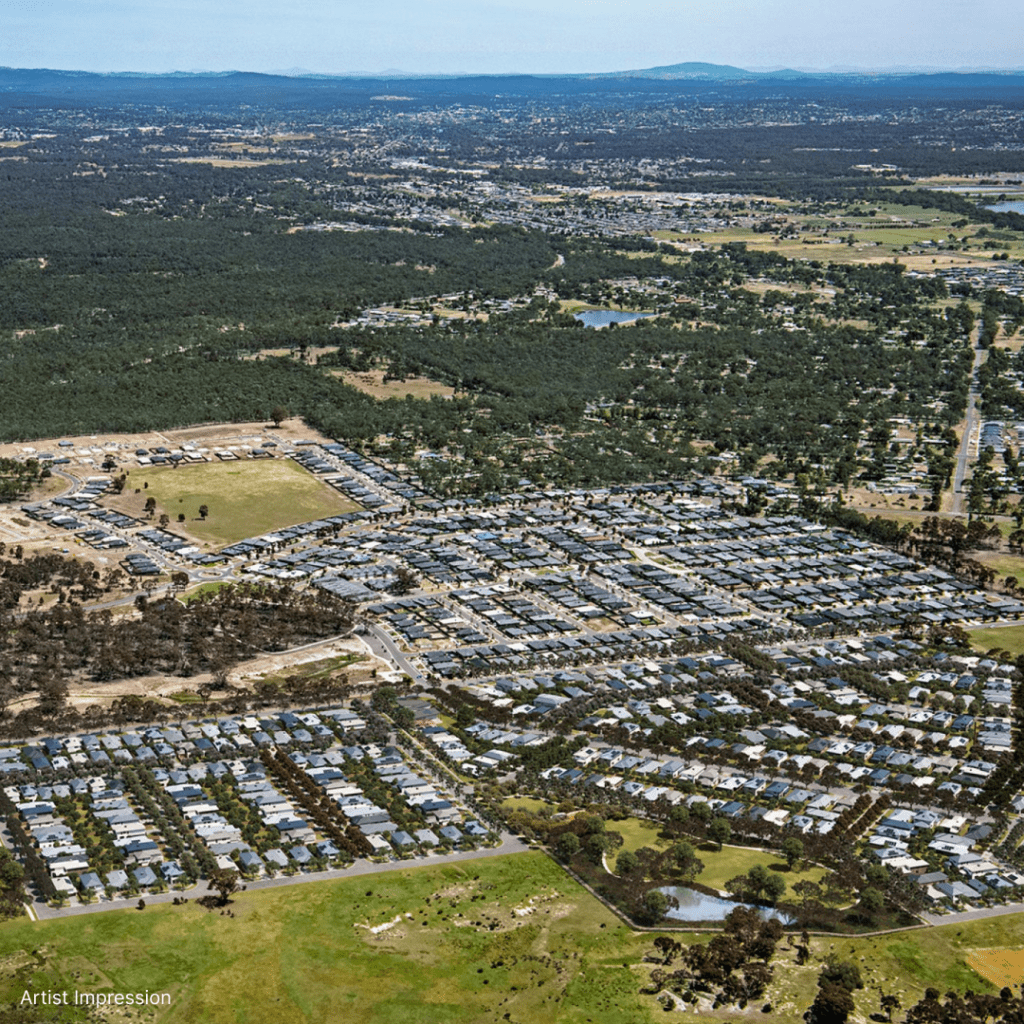

If you’re looking for a close-knit community that looks out for every resident, check out the available listings at Harlowe. Just 15 minutes from the Bendigo CBD, Harlowe is an exciting new masterplanned community of 400 home sites.

Get the chance to unlock a lifestyle of natural beauty, with Harlowe situated within quiet local parks, native bush and wetlands. With the Campaspe River at your doorstep, residents can enjoy dozens of unique bush trails and outdoor spaces within a stunning rural landscape. This can be a great way for you to escape the hustle and bustle of the city, while still being within a stones throw from the Bendigo city centre.

Being so close to Bendigo, you can enjoy all the amenities of one of the most vibrant cities in Australia. With a diverse range of eating options, Bendigo’s food community is so well-regarded that it was recognised by UNESCO as a Region of Gastronomy in 2019, the first Australian city to receive this honour, which acknowledges its commitment to providing high-quality food from locally sourced ingredients. Bendigo also offers a range of unique events and attractions for locals to enjoy, from the Bendigo Art Gallery to their world-class wind region; there’s always something to do.

Master-planned communities like Harlowe can be a great place to transform your lifestyle. As they develop, you can feel the buzz in sharing space that’s improving for the future. If this sounds like the perfect place for you, visit the Harlowe website. They offer a range of different house and land packages at different price points to suit every budget.

Purchasing your first home can be a stressful process for anyone. It forces you to balance your finances, with researching different properties and ploughing through complex legal processes. By understanding the different steps you’ll face when buying your first home, you can be better prepared for the process. If you’re still unsure about where to make your first property investment, consider the allotments available at Harlowe.